HADA DBANK is the first Digital Bank to combine Sharia Banking Module with Blockchain Technology, to create an ethical and responsible banking ecosystem. We are troubled by the current bank and financial institution persecution of their customers. Existing players make money out of thin air from debt and interest. This is why the global economy has collapsed over time, evident since the 1st century. The lack of responsibility charged by banks is brave enough. This is why we chose to be part of the current financial revolution through the establishment of a Bank, a caring and personal bank.

HADA DBANK will become the world’s first Blockchain-based Digital Bank to integrate Shariah Banking Module with Blockchain Technology, to create an ethical and responsible banking ecosystem. As our existing Digital Bank and newly created Blockchain Bank focus on Conventional Banking services, we chose to win Islamic Banking services due to the lack of such facilities. In 2016, sharia banking is worth USD 1.5 trillion globally.

TECHNOLOGY HADA DBANK:

HADA DBANK using personal blockchain that is stored in each node in the network. By default, the nodes are all controlled by HADA DBANK. Some nodes just save a copy of blockchain and did not take part in the process of confirmatory transaction (consensus Protocol). That node can act as a gateway node or backup server. A node that acts as a validator can be found on the network segment that is safe from the bank and made available through the gateway node.

The main core database is implemented in the structure blockchain, where each block is a set of transactions. Each new block defines the State of the new nucleus, in accordance with the circumstances of the previous block. The core database integrity is provided by blockchain and a consensus on it. Each block is connected in a cryptographic block to before. This feature ensures the ability to validate a database and a history of transactions at any time in the future. The main database stores all data that passes through the point.

HADA DBANK using personal blockchain that is stored in each node in the network. By default, the nodes are all controlled by HADA DBANK. Some nodes just save a copy of blockchain and did not take part in the process of confirmatory transaction (consensus Protocol). That node can act as a gateway node or backup server. A node that acts as a validator can be found on the network segment that is safe from the bank and made available through the gateway node.

The main core database is implemented in the structure blockchain, where each block is a set of transactions. Each new block defines the State of the new nucleus, in accordance with the circumstances of the previous block. The core database integrity is provided by blockchain and a consensus on it. Each block is connected in a cryptographic block to before. This feature ensures the ability to validate a database and a history of transactions at any time in the future. The main database stores all data that passes through the point.

Benefits:

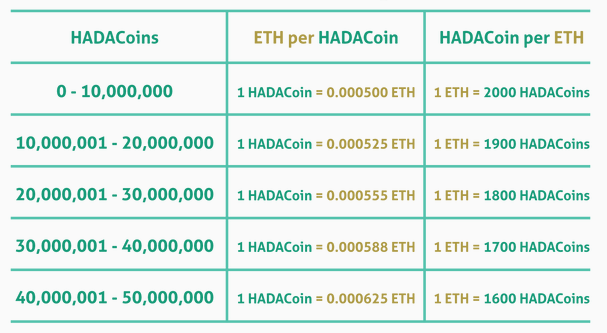

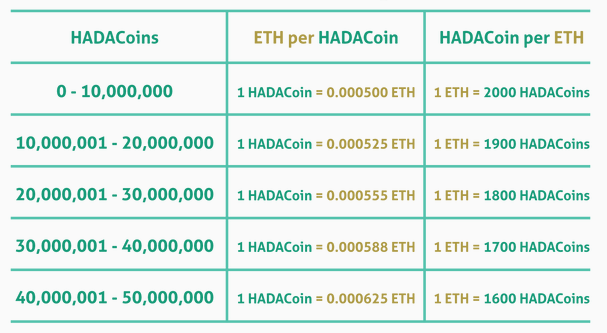

HADACoin:

We intend to raise capital for the development of DBANK HADA through its HADACoin. Buyers will be able to use HADACoin to conduct banking transactions or daily activities. Our customers will be issued with a Debit Card, which enables them to transact with our HADACoin, within the banking platinum or other merchants around the world.

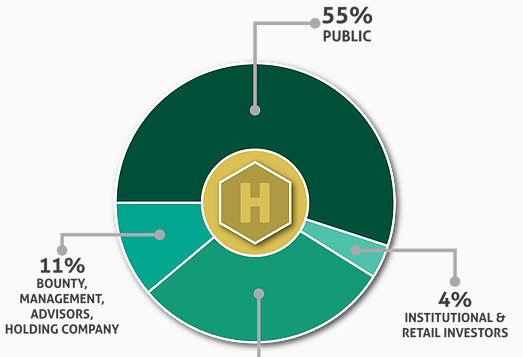

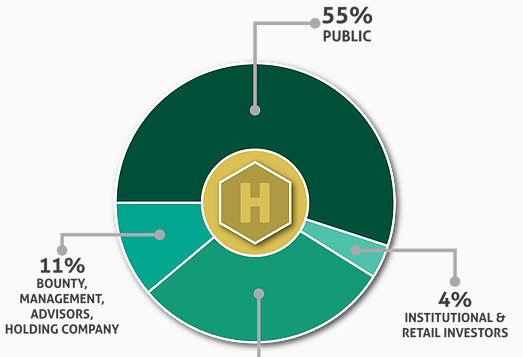

Distribution:

We intend to raise capital for the development of DBANK HADA through its HADACoin. Buyers will be able to use HADACoin to conduct banking transactions or daily activities. Our customers will be issued with a Debit Card, which enables them to transact with our HADACoin, within the banking platinum or other merchants around the world.

Distribution:

Pre-ICO:

Pre-ICO Funding Target

Soft Cap = 5,000 ETH

Hard Cap = 20,000 ETH

Pre-ICO Funding Target

Soft Cap = 5,000 ETH

Hard Cap = 20,000 ETH

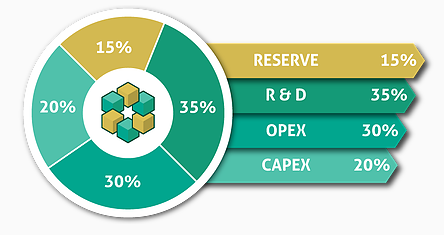

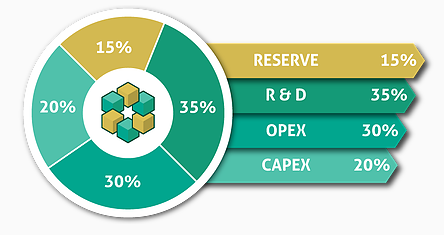

HADACoin Allocation:

35% — Capital raised by PRA-ICO will be allocated for research and development.

30% — For Operational Expenses.

20% — For Capital Shopping.

30% — For DBANK HADA Reserves.

35% — Capital raised by PRA-ICO will be allocated for research and development.

30% — For Operational Expenses.

20% — For Capital Shopping.

30% — For DBANK HADA Reserves.

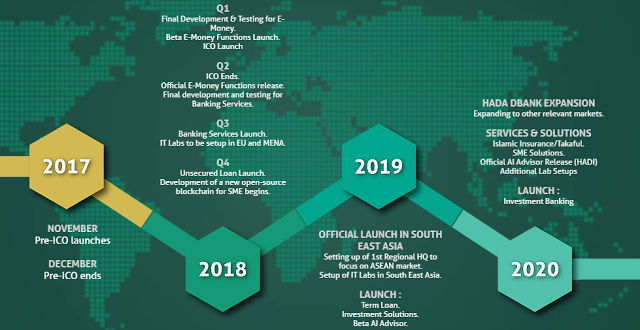

Road Map:

More Information:

Website: https://www.hada-dbank.com/

ANN Thread:https://bitcointalk.org/index.php?topic=2607739.0

Telegram: https://t.me/HADADBank

Facebook:https://www.facebook.com/hadadbank.official

Website: https://www.hada-dbank.com/

ANN Thread:https://bitcointalk.org/index.php?topic=2607739.0

Telegram: https://t.me/HADADBank

Facebook:https://www.facebook.com/hadadbank.official

Twitter : https://twitter.com/HadaDBank

Komentar

Posting Komentar